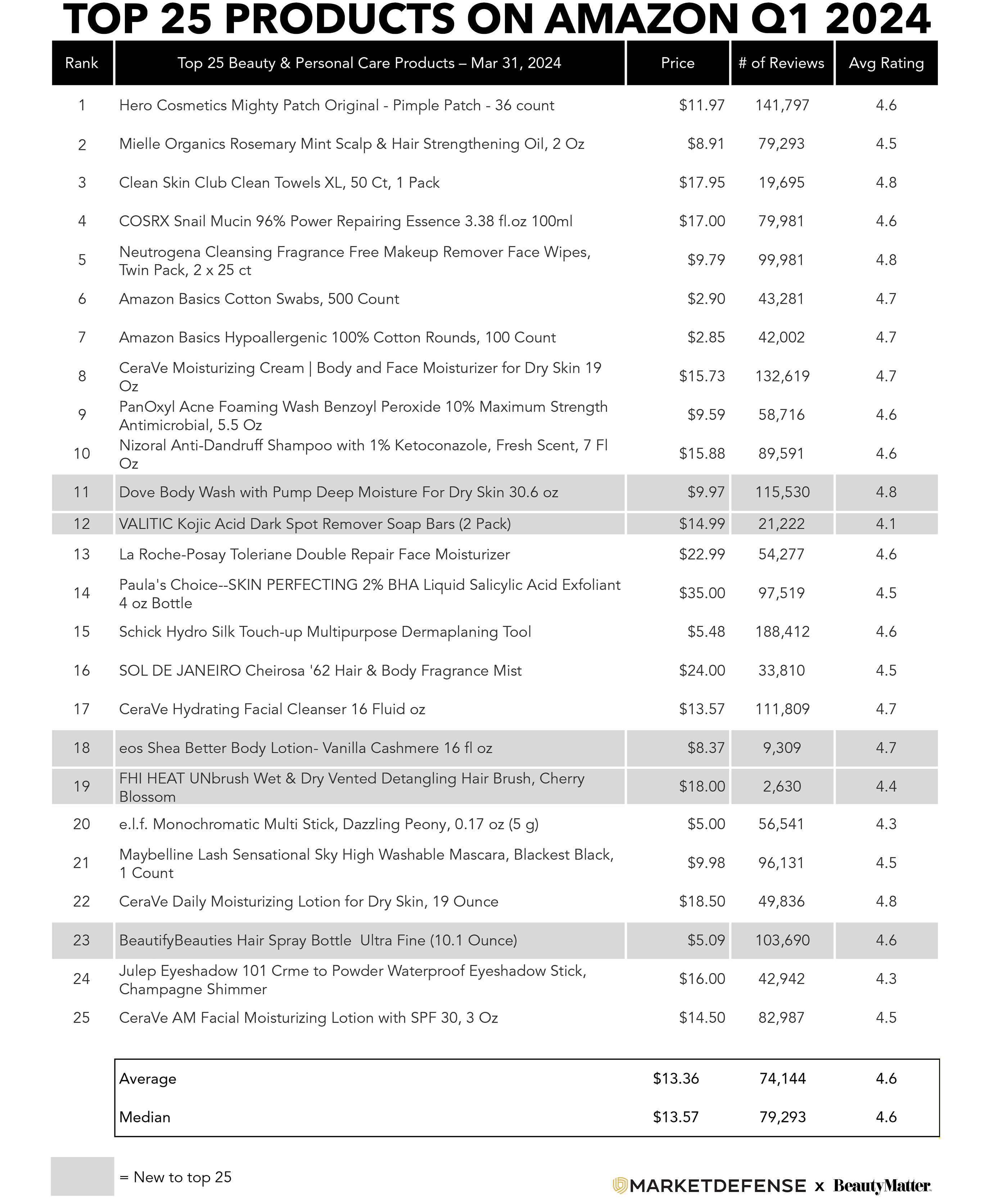

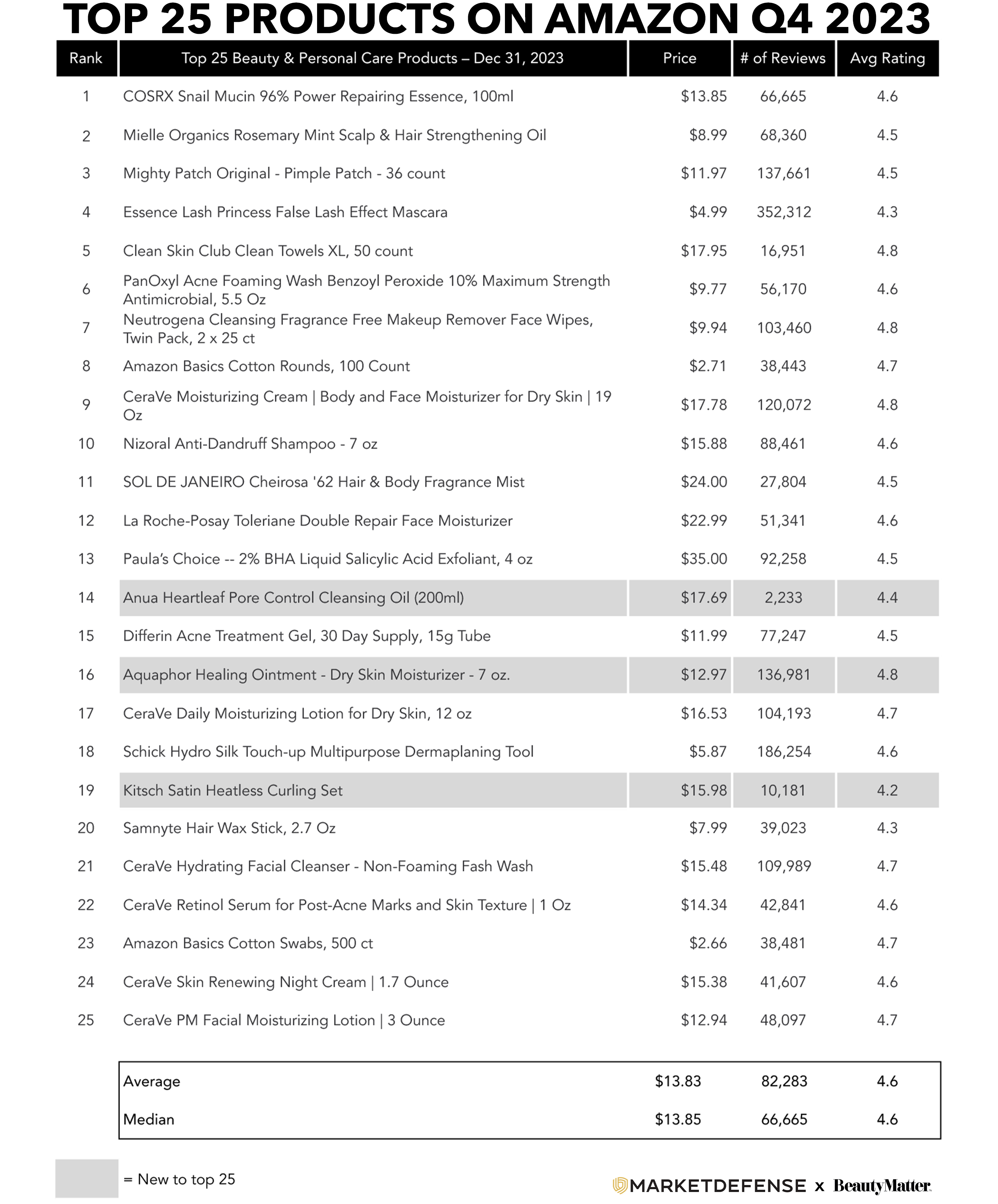

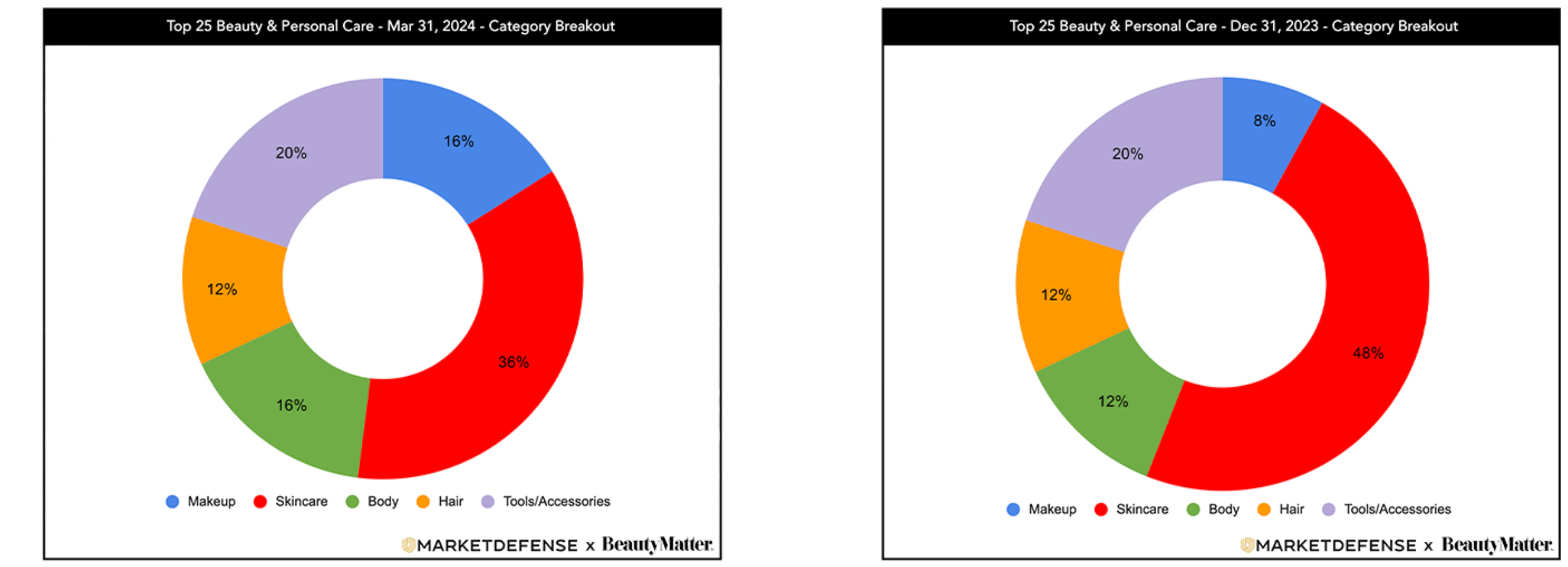

In Q1 2024, Amazon’s list of the Top 25 Beauty & Personal Care products was consistent with Q4 2023 results—largely dominated by skincare products, with makeup and body posting some modest gains. Leading this quarter’s Top 25 List was Hero Cosmetics’ Mighty Patch pimple patches, as last quarter’s #1 selling COSRX Snail Mucin 96% Power Repairing Essence dropped to #4. In the #2 slot was Mielle Organics Rosemary Mint Scalp Oil. Clean Skin Club Clean Towels XL was the #3 top-selling product, and Neutrogena’s Makeup Remover Face Wipes rounded out the top five. This is the highest placement for Clean Skin Club Clean Towels since entering the Top 25 list in Q1 2023. In the 12 months since Clean Skin Club entered the list, their reviews have grown by 84% and their average customer rating from 4.7 to 4.8.

Three new products broke into the Top 25 in Q1: VALITIC Kojic Acid Dark Spot Remover Soap Bars, eos Shea Better Body Lotion in Vanilla Cashmere, and the FHI Heat UNbrush Wet & Dry Vented Detangling Hair Brush. The FHI HEAT UNBrush and VALITIC Soap Bars retail for $18.99 and $14.99, respectively, helping to stabilize the average MSRP of the list at $13.36, which was roughly 3% less than last quarter. Only three products on the Q1 list broke a $20 MSRP: La Roche-Posay Toleriane Double Repair Face Moisturizer, Sol de Janeiro Cheirosa ’62 Hair & Body Fragrance Mist, and Paula’s Choice SKIN PERFECTING 2% BHA Liquid Salicylic Acid Exfoliant, which at $35 was the highest price-point product on the list this quarter. This highlights Amazon’s potential for more modestly priced beauty products.

The highest-ranked newcomer to the list is the TikTok viral hit VALITIC Kojic Soap, which has been steadily rising the ranks at Amazon this year to become the #1 ranking bath soap. Searches for “Kojic Acid Soap” were up 297% on Amazon, as customers look for nature-based remedies for “hyperpigmentation,” a search term that brings in 136,000 searches to Amazon monthly. CeraVe, once again, had four products in the Top 25; the only other brand with multiple products this quarter was Amazon’s private-label brand, Amazon Basics.

Mass brands like Mighty Patch, COSRX, PanOxyl, Neutrogena, and CeraVe made up the majority of the Skincare Top 10 in Q1. VALITIC Kojic Acid Dark Spot Remover Soap Bars joined the top 10 this quarter for the first time ever. The average price point of the Skincare Top 10 was $16.42.

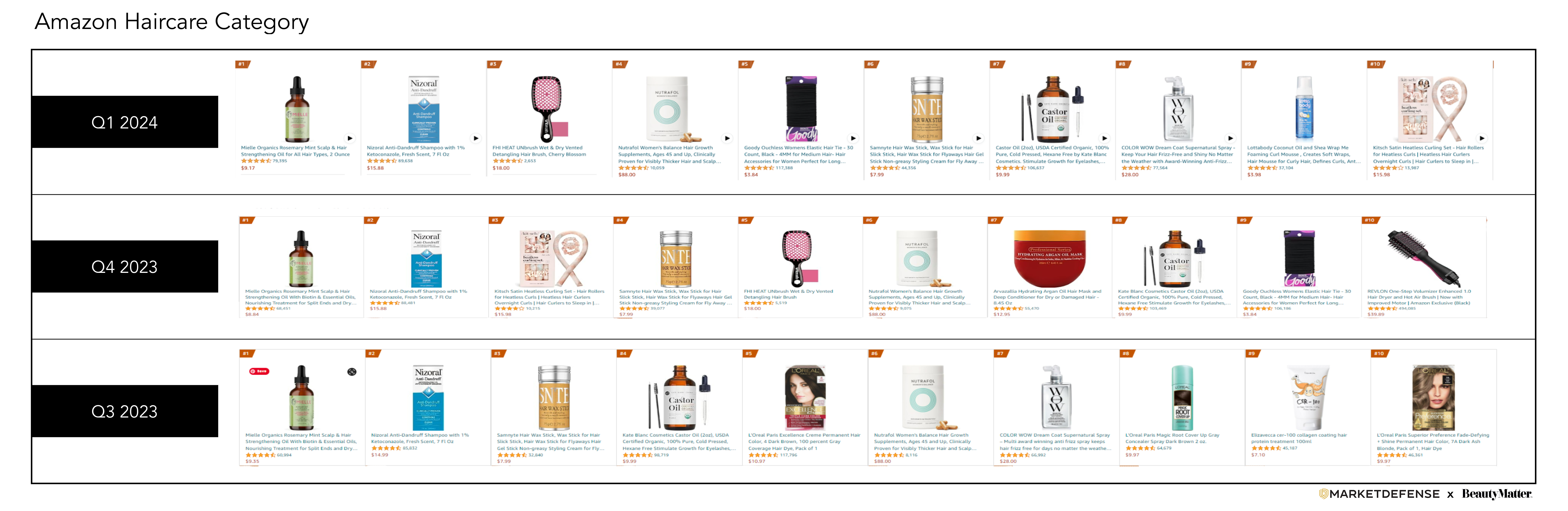

The Haircare Top 10 continued to be led by Mielle’s Rosemary Mint Scalp & Hair Strengthening Oil and Nizoral Anti-Dandruff Shampoo. Nutrafol’s Women’s Balance Hair Growth Supplements moved up two spots from last quarter, from number six to number four. Nutrafol’s movement up the list stands out because of its price point of $88.00, well above the Haircare Top 10 average of $20.08, or $12.53, excluding Nutrafol.

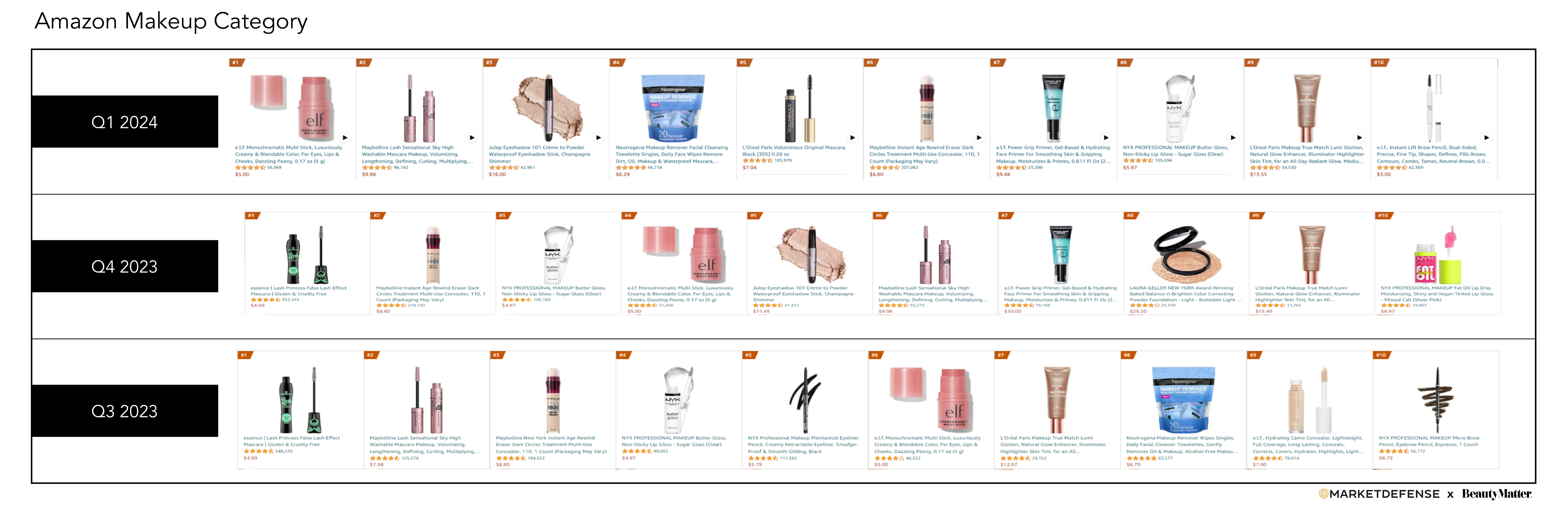

e.l.f. Cosmetics had three products in the Makeup Top 10 this quarter. The rest of the list was full of mass favorites from Maybelline, L’Oréal, and NYX. The average price point of the Makeup Top 10 was $8.51, down 17.3% from last quarter’s average of $10.29.

Navigating Private-Label Competition on Amazon

How significant is the Amazon Basics brand to Amazon’s overall beauty and personal care business? An indication of the impact of Amazon Basics on beauty and personal care sales is the rise of this quarter’s number 6 selling Amazon Basics Cotton Swabs, which first appeared in the Top 25 in Q1 2023. Not coincidentally, legendary Q-tips cotton swabs have not been in the Top 25 list since Q3 2022, despite being a list mainstay since we began tracking the Top 25 in 2021. At that time, the 500 count of the classic Q-tips Cotton Swabs was priced at $4.32, while Amazon Basic’s 500 count product sells today for $2.99.

Similar to the strategy used by private-label brands in brick-and-mortar stores, Amazon brands often create products similar to name-brand best-sellers on the site and sell them for a low price. Amazon introduced Amazon Basics as its first in-house private label brand in 2009 with a few batteries; it is now their largest owned brand with billions a year in sales. Amazon ramped up its private-label offering to hundreds of brands that operated in dozens of categories by 2017, but has now pared down to less than 20, WSJ reported in August 2023.

Through the approximately 150,000+ private-label products sold on its site, Amazon posts a private-label share of 3% in the household, health and beauty, and grocery sectors, which is lower than its competitors in beauty. Target owns about 50 private-label brands, and estimates are that Sephora's private-label line generates 7 to 10 percent of their total business. Customer demand for owned brands is on the rise, however, marking a significant growth opportunity for the Amazon Basics brand. According to Circana in their March 2024 “CPG Private Brands Update” report, private-label brand sales increased 6% year over year in the US to $217 billion in 2023, including a 2.1% increase in units in beauty. This seems to point in the direction of consumers on the hunt for value, particularly in product categories that are hard to distinguish from name brands.

If you are a beauty brand selling on Amazon, should you be concerned about Amazon Basics stealing your intellectual property? Due to criticism that Amazon was using its size, power, and data to push its own products and gain an unfair advantage over rival merchants that also use its platform, Amazon said in 2022 that it would commit “not to use such data for the purposes of selling branded goods as well as its private label products.” That is a vastly different message than was given at a congressional hearing in 2020 when Jeff Bezos said that he could not confirm Amazon didn’t use data it collects about product sales in its marketplace to launch its own private-label goods. “What I can tell you is we have a policy against using seller-specific data to aid our private-label business,” Bezos said. “But I can’t guarantee you that policy has never been violated.”

Whether due to congressional criticism or poor sales performance, Amazon has seemingly shifted away from promoting their owned private-label brands in the Beauty category. They launched skincare brand Belei—the name is a combination of "believe" and "beauty"—in 2019 to much fanfare, then quietly stopped selling in 2022.

“Competing with private-label beauty brands on Amazon can be challenging, but established beauty brands can employ several strategies to differentiate themselves and maintain a competitive edge,” said Vanessa Kuykendall, COO, Market Defense. Kuykendall went on to provide the following five pointers brands can use to rise above the competition from Amazon’s private-label competitors:

By focusing on these strategies, established beauty brands can effectively compete with private-label beauty brands on Amazon and maintain their position in the marketplace.

Previous Reports:

Q4 2023 Amazon Top 25 Beauty & Personal Care

Q3 2023 Amazon Top 25 Beauty & Personal Care

Q2 2023 Amazon Top 25 Beauty & Personal Care

Q1 2023 Amazon Top 25 Beauty & Personal Care